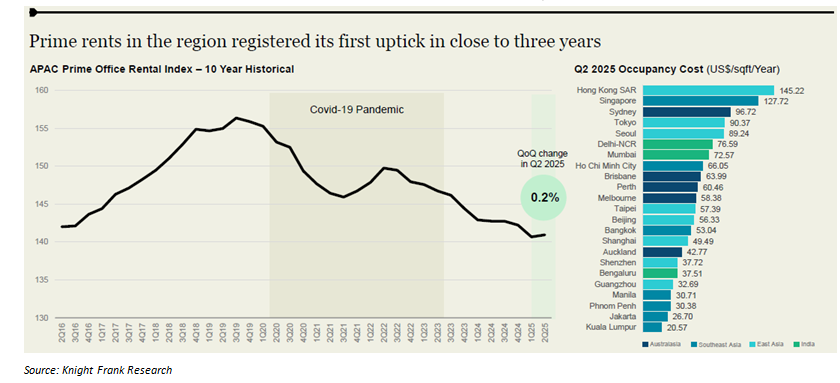

· Asia-Pacific prime office rents see first rise in nearly three years in Q2 2025

· 17 out of 23 monitored cities reported stable or increased rents YoY

· Hong Kong pricing opportunity deepens,rents down 34% since 2019

· Delhi-NCR and Mumbai rank 6thand 7th respectively in APAC Prime Office Rental Index

India’s three largest office markets, Bengaluru, Delhi-NCR, and Mumbai, delivered a standout performance in the Asia-Pacific region, registering the highest second-quarter leasing volume on record. According to Knight Frank’s Asia-Pacific Q2 2025 Office Highlights report, the three cities together leased 12.7 mn sq ft in Q2 2025, up 20% year-on-year (YoY). Robust leasing activity translated to an acceleration in Prime Office rents, which rose 4.5% YoY on average for the three markets. This momentum comes against a backdrop of volatile global conditions, reinforcing India’s growing strategic importance in global corporate real estate portfolios. Bengaluru remained the top-performing city, driven by Global Capability Centres (GCCs), while Delhi-NCR and Mumbai continued their upward trajectory in both leasing activity and rental value. Notably, Delhi-NCR and Mumbai ranked 6th and 7th respectively in the APAC Prime Office Rental Index. Knight Frank's findings signal not just a cyclical high, but a structural re-rating of India’s office markets to levels approaching the most resilient office markets globally.

APAC Prime Rental Rate Growth – Q2 2025

Forecast for the next 12 months

Shishir Baijal, Chairman & Managing Director, Knight Frank India, said, “India’s office market continues to display remarkable growth trajectory. The record second-quarter leasing across our top cities highlights the strategic role India now plays in global real estate portfolios. The consistent rise in occupier activity led by GCCs and Third-party IT Services reflects a structural shift in workspace demand, favouring quality infrastructure, future-ready locations, and scalable talent hubs. While global headwinds persist, India remains well-positioned to absorb and attract long-term capital flows and occupier investments in the commercial real estate sector.”

Delhi-NCR: Record Leasing, Sustained Growth

Mumbai: Steady Momentum with Investor Confidence

In Q2 2025, Mumbai recorded a 7% YoY rise in prime rents, reaching INR 323 per sqft per month, the second highest in India. Leasing remained healthy, underpinned by expansionary demand in core micro-markets such as BKC and Lower Parel. The vacancy rate stood at 17.4%, down from 19.7% last year. The city continues to attract occupiers looking for premium spaces with long-term investment appeal. The BFSI sector has been the traditional anchor of the Mumbai office market with the other service sectors claiming an increasing share in recent times. Global corporates are driving leasing demand, signalling growing investor confidence in the Mumbai office ecosystem.

Bengaluru: Leading India’s Office Market

Asia-Pacific Market Overview

While India led the leasing momentum in Q2 2025, the broader APAC office market also showed signs of stabilization. Regional prime rents rose 0.2% quarter-on-quarter (QoQ) the first increase in nearly three years. Leasing volumes in major Indian and Australian cities offset a continued slowdown in mainland China. Rents in Brisbane grew over 14% YoY, while Tokyo recorded the region’s lowest vacancy rate amid restrained supply. Despite policy support, Chinese tier-1 markets such as Beijing and Shanghai saw rents continue to decline. Hong Kong rents have now fallen 34% since Q4 2019, positioning the city as a cost-effective base for firms seeking to tap Chinese capital markets. Overall, conditions remain cautious but not contractionary, with tenant priorities shifting toward resilience, flexibility, and functionality.

Tim Armstrong, global head of occupier strategy and solutions, says, “As global disruption becomes the status quo, occupiers are rethinking real estate not just as a place to work, but as a strategic platform for growth. They want flexibility to pivot with speed, functionality that supports evolving business models, and resilience built into every square foot to weather what's ahead. Tenant activity for relocations is likely to remain modest as occupiers turn selective, shifting focus towards more holistic and dynamic strategies amid a flight-to-functionality.”

Christine Li, head of research, Asia-Pacific, Knight Frank adds, “Capital flows and corporate strategies are being reshaped as Trump's policies shift global dynamics and accelerate US-China decoupling. Chinese mainland companies are now favouring Hong Kong over the US as a listing destination, while global investors are increasing their presence in the region to tap investment opportunities and the expansion in private capital. Several financial firms have sealed high-profile leases in Hong Kong in recent months. At the same time, we have also observed an uptick in enquiries from Chinese companies looking to expand in Southeast Asia. The region's office markets are well placed to capitalise on this new trend, offering firms a strategic platform to continually tap growth opportunities while navigating rising geopolitical tensions.”

This shift is driving mainland Chinese and Hong Kong firms to explore Southeast Asia for expansion amid ongoing trade tensions, with companies keen to tap Singapore's bourse for regional market entry.Alternative investment manager Quantedge Capital exemplifies this trend, expanding its Singapore footprint to a 30,000 sq ft space in Capital Tower. Singapore remains a regional financial hub, with plans to boost the local stock exchange through a S$5 billion (US$3.9 billion) government programme.

Outlook remains cautious